Waivers protect businesses from legal action, as well as empower individuals to apply for financial assistance. When you request a financial waiver for school expenses or debt cancellation successfully, your pending payments will be canceled.

This article discusses methods of canceling payments in detail. Continue reading to find out cases where you can apply for a waiver.

What Is a Waived Payment?

A waived payment (waived fee or deferred compensation) is a financial loan, debt, or fee that has been fully or partially canceled upon request.

To get a payment exemption, you need to apply for a release of debt from the authority you owe. Your application should state the reason you can’t afford the payment. You also need to verify if you want a full or partial waiver.

A full waiver absolves you of the entire debt; you won’t have to pay a dime. A partial waiver exempts you from paying a certain portion of the debt, which you might still have to repay in due course.

Sometimes, the issuing authority can only grant you a deferral, giving you an extended grace period for loan servicing or repayment.

When Can You Waive a Payment?

You can defer payments in the following situations:

- Redundancy — credit card companies can defer payment to your loan when you lose your permanent employment and have yet to land a new job.

- Bankruptcy — government establishments can waive your loan payments when you or your business does not have the solvency to repay your debts without going under.

- Disablement — banks and other financial institutions can waive your debt when you or your dependant experiences a severe injury that limits your earning capacity.

- Terminal illness — financial houses can cancel your outstanding debt when you or your dependant are terminally ill, specifically if it is not covered by your insurance.

- Death — banks and government agencies can defer your outstanding loan payments when you die.

Other Types of Payment Waivers

If you do not qualify for one of the deferrals mentioned above, here are other circumstances that could qualify you for a waived payment.

Veteran status

War veterans registered with the Veterans’ Association (VA) can get a debt waiver, which forgives them of any loans they are unable to repay to the VA.

Fee waivers

To file a civil suit, you need to pay court fees. If you are not financially stable enough to pay these fees, the civil court can choose to waive them for you.

Also, domestic and international students can apply for fee cancellation or deferral if they lack the financial means to cover tuition, application, and other expenses. You will need to write a fee waiver letter to seek approval.

Government-sponsored waivers

When you receive unemployment benefits, and you think you were overpaid, it is your legal obligation to notify the paying authority. In this case, you need to draft an overpayment waiver request to ask for approval to keep the extra cash.

Individuals over 60 are entitled to the senior citizen late payment waiver if they are struggling to meet up with their payments. To qualify for this deferral, your income level has to be below 125% of the Federal Poverty Level.

Similarly, you can complete the Electronic Filing and Payment Waiver Request application if you meet the following criteria:

- You have no access to computers or the Internet.

- You have a track record of paying your taxes on time.

During natural emergencies like floods and pandemics, affected people are entitled to Emergency and Disaster Waivers and Flexibilities. Under section 1135 of the Social Security Act, the government can waive specific requirements for Medicare, Medicaid, Children’s Health Insurance Program (CHIP), and Health Insurance Portability and Accountability Act (HIPAA).

How to Use Online Waivers

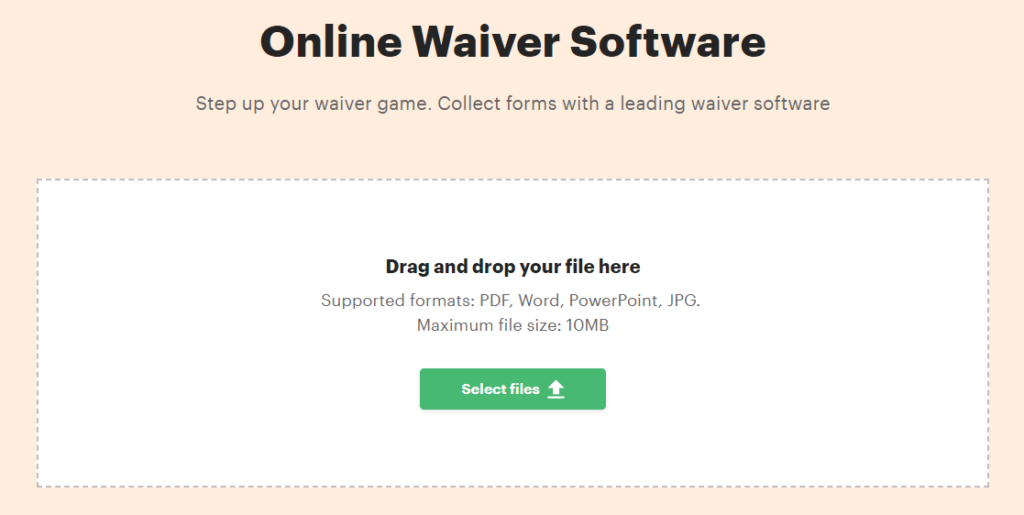

Suppose you want to request a fee waiver before the application deadline, and you can’t make it to a printer. You can use the PandaDoc Waivers tool to sign and save your waiver instantly.

The process is straightforward:

- Go to the platform

- Upload the waiver form.

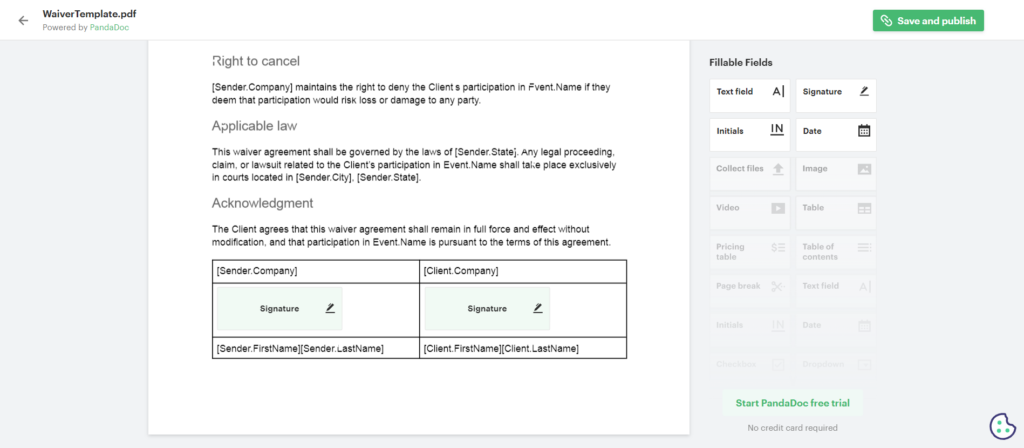

- Fill out all essential details like name, address, and date of birth.

- Drag and drop a signature field to add your signature.

- Click on “Save and publish” to complete the process.

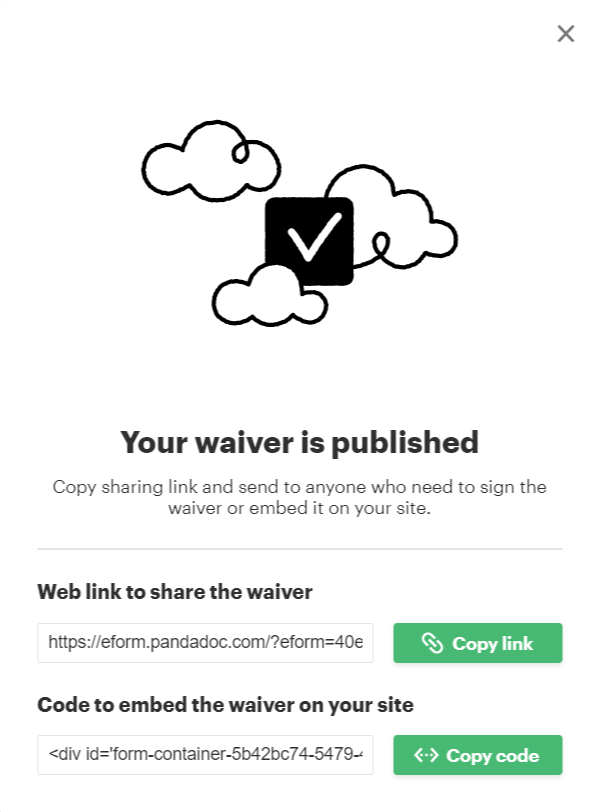

- Your signed waiver is stored in your profile.

- You can now download it or send it to your legal advisor to review before submission.

Conclusion

Waived payments allow you to manage your debt without going bankrupt. When requesting a waiver, you must be transparent in showing the limitations of your financial situation. If you have been affected by war, natural disasters, or the other specific instances listed above, you can apply for loan deferral or complete cancellation.